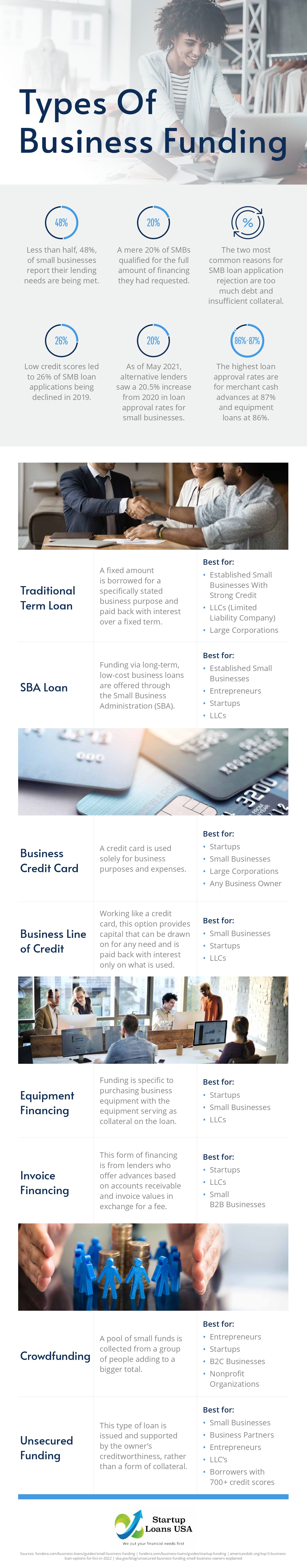

Crowdfunding As A Funding Option:

Crowdfunding is one of the more current methods of financing a startup that has been acquiring parcel of ubiquity recently and can be one of the best investments for small business owners. It resembles taking an advance, pre-request, commitment or speculations from more than one individual simultaneously.

This is the means by which crowdfunding works – A business person will set up a nitty gritty portrayal of his business on a crowdfunding stage. He will specify the objectives of his business, plans for making a benefit, how much subsidizing he needs and for what reasons, and so forth and afterward purchasers can learn more about the business and provide funding in the event that they like the thought. People giving fund will make upfront vows with the guarantee of pre-purchasing the product or giving a gift. But definitely you must know what is operating profit margin before you can do this.Anybody can contribute cash toward aiding a business that they truly have confidence in.

Why you ought to consider Crowdfunding as a subsidizing choice for your business:

The best thing about swarm subsidizing is that it can likewise create revenue and henceforth helps in showcasing the item close by financing. It is additionally a shelter in case you are not sue if there will be any interest for the item you are chipping away at. This cycle can remove proficient financial backers and dealers by placing subsidizing in the possession of average citizens. It likewise may draw in funding venture down the line if an organization has an especially fruitful mission.

Additionally remember that crowdfunding is a cutthroat spot to procure financing, so except if your business is totally unshakable and can acquire the consideration of the normal customers through a depiction and a few pictures on the web, you may not discover crowdfunding to work for you eventually, You can check out Retail POS app here.

The most clear benefit of crowdfunding for a new business or individual is its capacity to give admittance to a bigger and more assorted gathering of financial backers/allies. With the pervasiveness of web-based media, crowdfunding stages are a fantastic way for organizations and people to both develop their crowd and get the financing they need.

Moreover, numerous crowdfunding projects are rewards-based; financial backers might will partake in the dispatch of another item or get a present for their speculation. For example, the creator of another cleanser made out of bacon fat might send a free bar to every one of its financial backers. Computer games are a mainstream crowdfunding speculation for gamers, who regularly get advance duplicates of the game as a prize.

Value based crowdfunding is filling in prominence since it permits new businesses to fund-raise without surrendering control to funding financial backers. Now and again, it likewise offers financial backers the chance to acquire a value position in the endeavor.

Likely weaknesses of crowdfunding incorporate the conceivable harm to you or your organization’s standing brought about by “turning” to crowdfunding, the expenses related with the crowdfunding site, and, essentially on certain stages, on the off chance that you don’t arrive at your subsidizing objective, any money that has been promised will be gotten back to your financial backers and you will get nothing.

Infographic provided by Startup Loans USA, a business startup loans company